We are finding interest

rate offers as low as

4.99% - 6.99%

SOMETHING TO THINK ABOUT

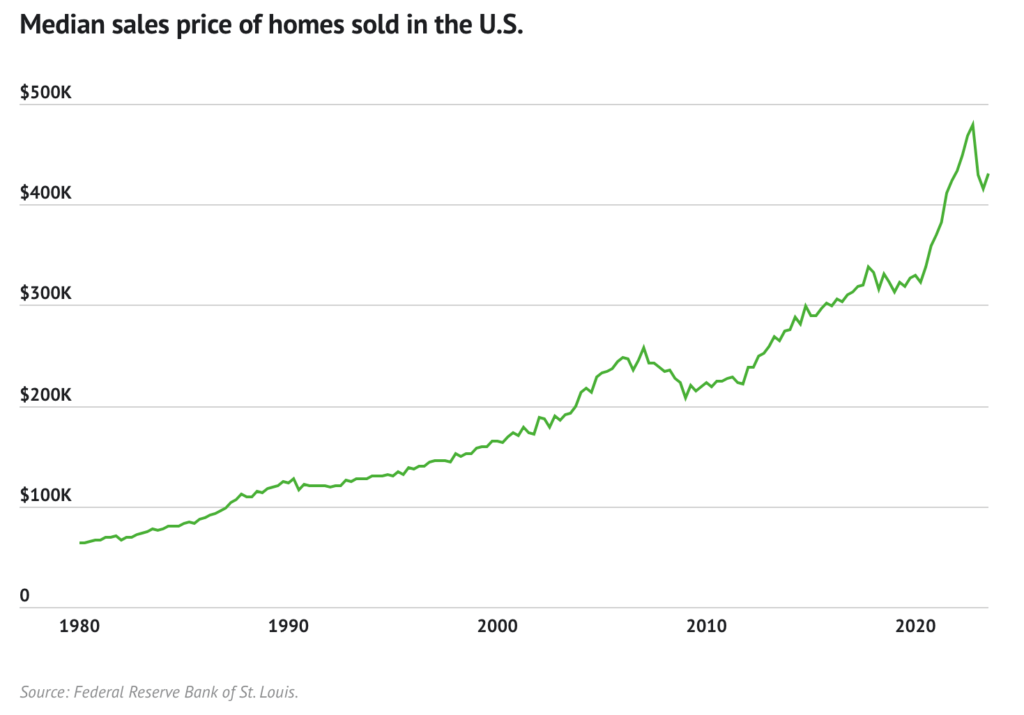

Let me ask you a question: When is the best time to buy anything of value? The short and simple answer is, when prices are their lowest right? Take a look at the chart below that tracks home prices from the 1980’s to 2023. Can you pick out the opportunities? If you’ll notice, that last dip in 2022 has now ended and the market is slowly beginning to pick up steam.

While its true that interest rates should factor into any financing decision, if you compared the history of interest rates to the history of home prices you would see that interest rates rise and fall but historically speaking interest rates have “fallen” far more significantly, and have “remained” low. Conversely, home prices barely and rarely rise and fall as you can see in the chart below, but continue to “rise” over time.

Here are the questions home buyers should be asking:

- Can we afford the home we want now?

- Will the price of the home we want be more expensive next year?

- Although interest rates are currently higher than We’d like, will they come back down?

- Is it better to buy a home when there are fewer buyers on the market and avoid multiple offers?

- Do we understand that we can refinance a higher interest rate loan when rates come back down?

I heard someone say this a couple of years ago: “Buy the home of your dreams when you can afford the home of your dreams, and rent the rate”. I think this sums up the above nicely. Since you can always refinance a higher interest rate loan, but the home of your dreams is not alway affordable, readily available, or without buying competition, “rent the rate” then refinance. In the end, since home prices continue to rise, and buyer demand has its largest buying wave in history on the horizon, buying when you can afford to buy makes a lot of sense.

Call today to learn where you can find great homes like these!

214.926.3302